Featured Article

New ACA Subsidies Available April 1

Katie Keith - Health Affairs - Mar 17, 2020

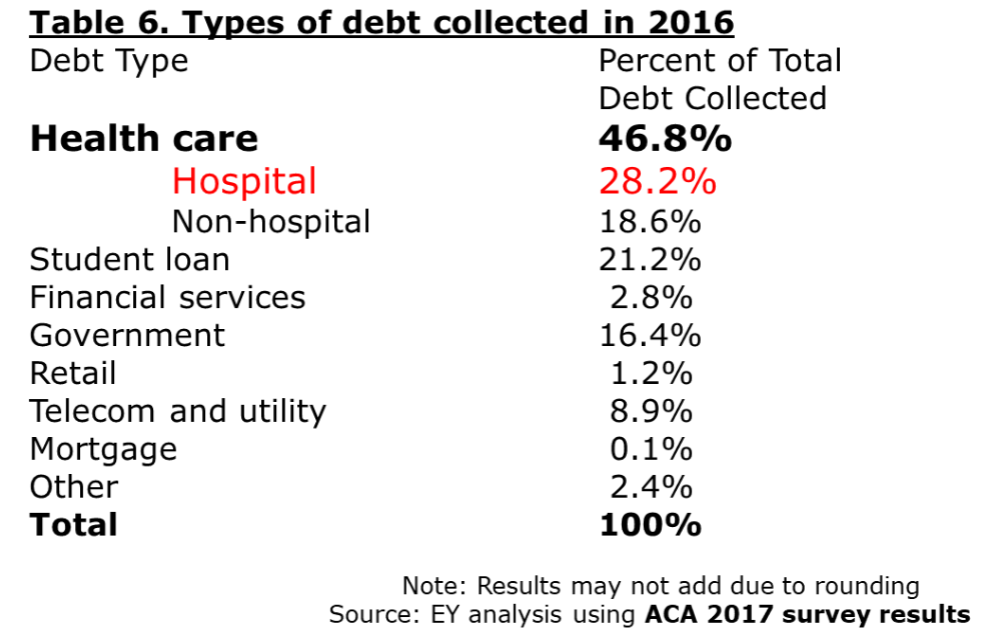

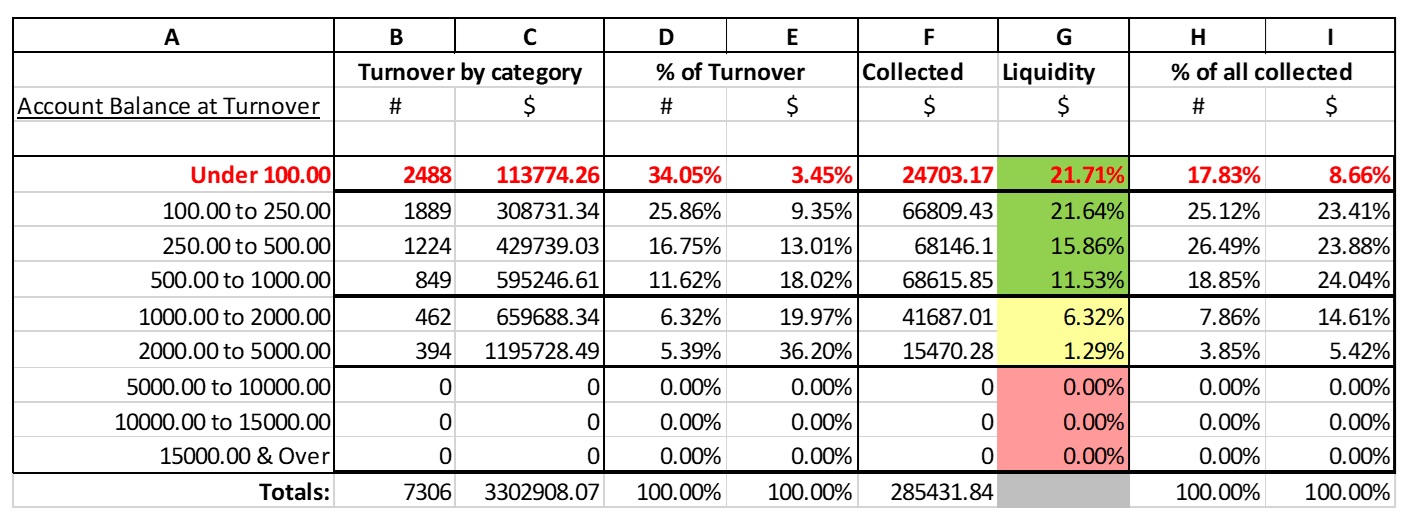

According to the article, "President Biden signed the sweeping American Rescue Plan Act into law on March 11, 2021. Among its many provisions, the new law includes historic expansions of the Affordable Care Act (ACA) that will significantly improve premium affordability and access to marketplace coverage." Find out how the American Rescue Plan affects insurance coverages, unemployment, and what the impact of the enhancements is expected to be...

- 5 min read